In recent times, the Federal Government of Nigeria, through the Central Bank (CBN), has been rolling out various financial support programs aimed at empowering citizens and boosting economic growth. If you are interested in applying for a ₦500,000 FG loan by CBN, here’s a comprehensive guide to help you navigate the application process.

Step 1: Stay Informed

The first and crucial step is to stay informed about the existence of such a loan program. Keep an eye on official announcements from the CBN, the government, and reputable news sources. Check the CBN’s official website and other government portals regularly for updates on new loan schemes.

Step 2: Eligibility Criteria

Once you are aware of the loan program, carefully review the eligibility criteria. Government loans typically target specific groups or sectors. Ensure you meet the required qualifications, which may include factors such as age, income level, business type, or employment status.

Step 3: Gather Necessary Documentation

Government loan applications often require a set of documentation to verify your eligibility. This may include identification documents, proof of income, business registration documents (if applicable), and other supporting materials. Prepare these documents in advance to streamline the application process.

Step 4: Visit Official Channels

To apply for the ₦500,000 FG loan by CBN, visit the official channels designated for the application process. This might be an online portal, a physical branch, or another specified method. Be cautious of scams and only use official channels to avoid falling victim to fraudulent schemes.

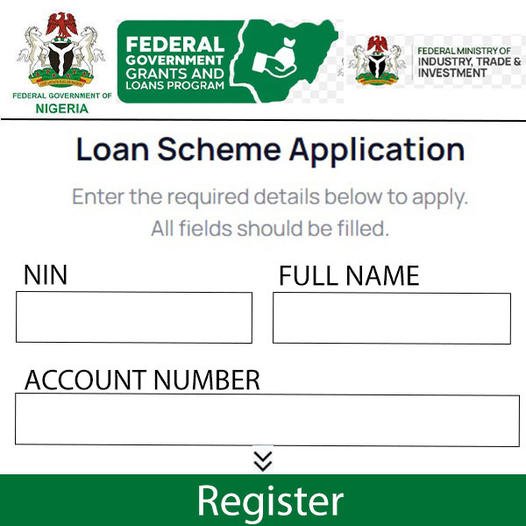

Step 5: Online Application Process

If the application process is online, carefully follow the instructions provided on the official portal. Fill out the required forms accurately and truthfully. Provide all necessary documentation and information as requested. Double-check your entries before submitting to avoid any errors.

Step 6: Await Processing

After submitting your application, the next step is to wait for the processing to take place. Government loan programs often receive a high volume of applications, so be patient during this phase. You may be notified of the status of your application through the contact information provided during the application process.

Step 7: Follow Up

If there are delays or if you haven’t received any communication regarding your application, don’t hesitate to follow up. Contact the designated helpline or customer service for updates on your application status. Persistence and proactive communication can be key in ensuring your application progresses smoothly.

Step 8: Responsible Use of Funds

Once your loan application is approved and funds disbursed, it’s crucial to use the funds responsibly. Abide by the terms and conditions of the loan agreement, and ensure that the funds are used for the intended purpose, whether it’s for business expansion, education, or other approved uses.

Who Can Apply?

If you run a micro, small or medium-sized enterprise (MSME) duly registered with the Corporate Affairs Commission (CAC), this loan opportunity is for you. Additionally, you must:

- Be a Nigerian citizen or have a valid Nigerian resident permit.

- Have a viable business proposal with clear market potential.

- Possess collateral, or have a guarantor who meets the collateral requirements.

- Not be a defaulter on any previous loan from NIRSAL or any other financial institution.

What are the loan terms?

- Loan amount: Up to ₦500,000 (depending on your business plan and needs).

- Interest rate: 5% per annum (attractive compared to typical commercial loan rates).

- Loan tenor: Up to 3 years (with possible extension upon review).

- Moratorium period: Up to 6 months on principal repayment (giving you time to get your business established).

Now, for the application process:

1. Choose your application channel:

You can apply online or offline.

- Online: Visit the NIRSAL Microfinance Bank Plc website (https://www.cbn.gov.ng/out/2011/publications/reports/dfd/brief%20on%20nirsal.pdf) and click on “MSMEDF” to access the application form.

- Offline: Download the application form from the website or collect a hard copy from any NIRSAL branch nationwide.

2. Gather your documents:

- Completed application form with signed passport photographs.

- Valid government-issued ID (international passport, driver’s license, national ID card).

- Business registration certificate.

- Audited financial statements for the past two years (if available).

- Tax clearance certificate.

- Utility bills or rent receipts as proof of address.

- Detailed business plan outlining your proposed venture, market research, and financial projections.

- Evidence of collateral or guarantor documents (if applicable).

3. Submit your application:

- Online applications are submitted through the NIRSAL website.

- For offline applications, submit your completed form and documents to any NIRSAL branch.

4. Wait and be patient:

The processing time can vary, but be prepared to wait around 4-8 weeks after submitting your application. NIRSAL will contact you through the email address or phone number you provided in your application.

5. Attend training:

If your loan application is successful, you’ll be required to attend mandatory entrepreneurship training before the loan is disbursed. This training equips you with the skills and knowledge to manage your business effectively and increase your chances of success.

Top Tips for a Successful Application:

- Prepare a strong business plan: Highlight the viability of your business, identify your target market, and demonstrate how you’ll use the loan effectively.

- Maintain accurate financial records: This will strengthen your application and give NIRSAL confidence in your ability to manage the loan.

- Meet all eligibility requirements: Ensure you fulfill all the criteria before applying to avoid delays or rejections.

- Seek help if needed: Don’t hesitate to reach out to NIRSAL or business development agencies for guidance and support throughout the process.

Remember, securing a loan is just the first step. Use the funds wisely, invest in your business, and work hard to make it a success!

By following these steps and applying strategically, you can boost your chances of securing your ₦500,000 CBN loan and take your business to the next level. Good luck!

Additional Resources:

- NIRSAL Microfinance Bank Plc website: https://www.cbn.gov.ng/out/2011/publications/reports/dfd/brief%20on%20nirsal.pdf

- NDE official website: [https://youwinconnect.org.ng/national-directorate-of-employment/]

- NIRSAL MSME Toolkit: [https://sqhub.ng/nirsal-how-to-apply-for-new-nmfb-sme-loan/]

This comprehensive guide should set you on the right path to accessing your share of the CBN’s ₦500,000 loan. Remember, with careful planning and a bit of hard work, you can turn your business dreams into reality.

Conclusion

Applying for a ₦500,000 FG loan by CBN requires careful preparation, adherence to guidelines, and patience throughout the process. By staying informed, meeting eligibility criteria, and following the official application channels, you increase your chances of successfully securing the loan and contributing to your personal or business development.

Please note that the steps outlined in this guide are general and may not specifically apply to the ₦500,000 FG loan by CBN. Always refer to the latest information provided by the CBN and relevant government authorities for the most accurate guidance.

Remember to replace the placeholder information with actual details once the specific loan program is officially announced and details are available. Additionally, always refer to official sources for the most accurate and up-to-date information.