In a bid to empower Nigerian entrepreneurs and small business owners, the National Directorate of Employment (NDE) has introduced a loan program offering ₦250,000 to eligible applicants. This financial assistance aims to stimulate economic growth and foster self-employment.

How To Apply For The ₦250k NDE Loan

If you’re interested in securing this loan, you can just follow our comprehensive step-by-step guide to navigate through the application process seamlessly.

Step 1: Check Eligibility Criteria Before diving into the application process, ensure you meet the eligibility criteria set by the NDE. Typically, these criteria include being a Nigerian citizen, having a viable business plan, and falling within a certain age range. Carefully review the requirements to confirm your eligibility.

Step 2: Develop a Viable Business Plan The NDE places a strong emphasis on funding businesses with growth potential. To increase your chances of approval, craft a detailed and well-researched business plan. Outline your business goals, target market, revenue projections, and a clear plan for utilizing the ₦250,000 loan. A solid business plan demonstrates your commitment and the potential for the loan to make a positive impact on your venture.

Step 3: Gather Necessary Documentation Prepare a comprehensive set of documents to support your loan application. This may include a valid form of identification, proof of business registration, tax identification number (TIN), bank statements, and any other documentation stipulated by the NDE. Ensuring you have all required documents ready will expedite the application process.

Step 4: Visit the NDE Official Website Navigate to the official website of the National Directorate of Employment (https://nde.gov.ng/) to access the loan application portal. On the homepage, look for the loan application section or any relevant links that direct you to the loan application page.

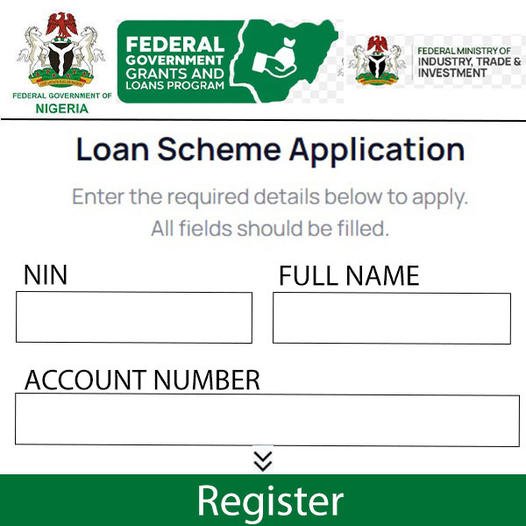

Step 5: Register an Account If you haven’t already registered an account on the NDE portal, you’ll need to do so to proceed with the loan application. Provide accurate and up-to-date information during the registration process, as this information will be used to verify your identity and assess your eligibility for the loan.

Step 6: Complete the Loan Application Form Once registered, log in to your account and locate the loan application form. Fill out the form with accurate and detailed information, ensuring that all required fields are completed. Double-check your entries before submitting the application to avoid any errors.

Step 7: Upload Supporting Documents Attach all the necessary supporting documents to your loan application. This may include your business plan, identification documents, and any other files requested by the NDE. Ensure that the uploaded documents are clear, legible, and in the specified format.

Step 8: Review and Submit Before finalizing your application, carefully review all the information provided. Check for any errors or omissions and make corrections as needed. Once satisfied, submit your application. You may receive a confirmation message or reference number upon successful submission.

Step 9: Monitor Application Status After submitting your application, keep a close eye on the application status. The NDE may provide updates on the progress of your application through the online portal or via email. Be patient during the review process, as it may take some time for the NDE to assess and make decisions on loan applications.

How To Apply For The FG CBN ₦250k NDE Loan Online

Applying for the FG CBN ₦250k NDE Loan Online

The FG CBN ₦250k NDE loan, also known as the Micro, Small and Medium Enterprises Development Fund (MSMEDF), is designed to support micro, small and medium-sized enterprises (MSMEs) in Nigeria. The application process is currently ongoing, and you can apply online through the portal provided by the NIRSAL Microfinance Bank Plc.

Here’s a step-by-step guide on how to apply for the loan online:

1. Eligibility:

Before applying, ensure you meet the eligibility criteria set by the NDE and NIRSAL. Some key requirements include:

- Being a Nigerian citizen or have a valid Nigerian resident permit.

- Owning and operating a registered MSME in Nigeria.

- Having a valid Bank Verification Number (BVN).

- Not being a defaulter on any previous loan from NIRSAL or any other financial institution.

2. Preparation:

Gather the necessary documents before starting your application. These may include:

- Valid government-issued ID (international passport, driver’s license, national ID card)

- Business registration certificate

- Audited financial statements for the past two years (if available)

- Tax clearance certificate

- Utility bills or rent receipts as proof of address

- Passport photograph

3. Application Process:

- Visit the NIRSAL Microfinance Bank Plc website: https://nmfb.com.ng/

- Click on the “Apply Now” button for the MSMEDF loan.

- Create a new account or log in to your existing account if you have previously applied for a loan through NIRSAL.

- Carefully read and understand the loan terms and conditions.

- Fill out the online application form, providing accurate and complete information about yourself and your business.

- Upload all required documents in the designated format.

- Review your application and ensure all information is correct before submitting.

- Submit your application and wait for further instructions from NIRSAL.

4. Important points to remember:

- The application process is free of charge. Do not pay any fees to anyone for assistance with your application.

- NIRSAL will contact you directly through the email address or phone number you provided in your application.

- Processing times may vary, but you can expect to receive a decision within a few weeks.

- If your application is successful, you will be required to attend mandatory entrepreneurship training before the loan is disbursed.

Additional Resources:

- NIRSAL Microfinance Bank Plc website: https://nmfb.com.ng/

- NDE official website: https://youwinconnect.org.ng/national-directorate-of-employment/

- NIRSAL MSME Toolkit: https://sqhub.ng/nirsal-how-to-apply-for-new-nmfb-sme-loan/

How To Apply For Federal Government Palliative 2023 Online?

Unfortunately, there is no single, universal “federal government palliative” program with online applications in Nigeria as of December 26, 2023. The government has implemented various palliatives in 2023 to address different issues, and the application process often depends on the specific initiative.

Here’s how to navigate the landscape:

1. Identify the specific palliative you’re interested in:

There are different programs aimed at different beneficiaries:

- Fuel subsidy removal palliatives: These include initiatives like N50,000 grants for vulnerable households, N75bn loan facility for market women, and N125bn for micro, small and medium-sized enterprises (MSMEs).

- Presidential Conditional Grant Programme & Presidential Palliative Loan Programme: These offer N50,000 grants (Nano businesses) and loans (MSMEs and manufacturers) to cushion fuel subsidy removal effects.

- Other sector-specific programs: There might be palliatives for agriculture, transportation, workers, etc.

2. Find out the eligibility and application details:

Once you identify the relevant program, research its eligibility criteria, application process, and deadlines. Each program has its own requirements and procedures. Some might require online registration on specific platforms, while others might involve offline applications through government agencies or partner organizations.

3. Stay updated with reliable sources:

Information about government programs can change quickly. To avoid misinformation, rely on official sources like:

- Federal Ministry of Finance, Budget and National Planning website: https://nationalplanning.gov.ng/

- National Directorate of Employment website: https://infomediang.com/nde-office-nigeria/

- NIRSAL Microfinance Bank Plc website: https://nibloans.nmfb.com.ng/

- Credible news websites and media platforms

4. Beware of scams:

Unfortunately, fraudsters exploit people’s need for assistance. Be cautious of unsolicited messages or offers claiming easy access to government palliatives. Stick to official channels and verify information before taking any action.

I understand this might seem complex, but hopefully, this information gives you a starting point. If you tell me which specific palliative you’re interested in, I can try to provide more specific details about the application process.

Remember, it’s crucial to rely on official sources and exercise caution to avoid falling victim to scams.

How Do I Register For Government Palliative?

As of today, December 26, 2023, there isn’t a single, nationwide “government palliative” program with online registration in Nigeria. Various initiatives target different groups and require specific application processes. To help you navigate this, I need a little more information.

Tell me which specific government palliative program you’re interested in registering for. Knowing the program will allow me to provide accurate details about eligibility, application procedures, and official channels to avoid scams.

Here are some examples of potential programs:

- Fuel subsidy removal palliatives: N50,000 grants for vulnerable households, N75bn loan facility for market women, N125bn for MSMEs.

- Presidential Conditional Grant Programme & Presidential Palliative Loan Programme: N50,000 grants (Nano businesses) and loans (MSMEs and manufacturers) to cushion fuel subsidy removal effects.

- Other sector-specific programs: Might exist for agriculture, transportation, workers, etc.

Once you tell me which program you’re interested in, I can guide you through the specific registration process. Remember, relying on official sources like government websites and avoiding unsolicited offers is crucial to ensure your safety and receive genuine assistance.

What Is NESP Grant?

NESP grant” can refer to a few different things depending on the context. To give you the most accurate answer, I need more information. Please tell me:

- Where did you hear about the NESP grant? Knowing the source might help narrow down the possibilities.

- What country are you inquiring about? NESP might stand for different programs in different countries.

For example, NESP could refer to:

- Nigeria Economic Sustainability Plan (NESP) grants: Offered under the Nigerian government’s NESP initiative, they support micro, small and medium-sized enterprises (MSMEs) through various schemes like Guaranteed Offtake Scheme and support for State Governments.

- Nurturing Emerging Scholars Programme (NESP) in South Africa: Launched by the Department of Higher Education, it identifies postgraduate students interested in academic careers and provides them with scholarships and development programs.

- Non-English Speaking Program (NESP) in the United States: Offered by some states and districts, it helps non-English speaking students acquire English language skills to succeed in academic settings.

Knowing more context will help me provide you with accurate and relevant information about the NESP grant you’re interested in.

Conclusion: Securing the ₦250,000 NDE loan can be a significant boost for your business aspirations. By following this step-by-step guide, you’ll be well-prepared to navigate the application process and increase your chances of success. Remember to stay informed, fulfill all eligibility criteria, and present a compelling business plan to showcase the potential impact of the loan on your entrepreneurial journey. Good luck!